10 Easy Facts About Best Broker For Forex Trading Explained

10 Easy Facts About Best Broker For Forex Trading Explained

Blog Article

The Buzz on Best Broker For Forex Trading

Table of ContentsNot known Factual Statements About Best Broker For Forex Trading Unknown Facts About Best Broker For Forex TradingThe smart Trick of Best Broker For Forex Trading That Nobody is DiscussingGetting The Best Broker For Forex Trading To WorkA Biased View of Best Broker For Forex Trading

Because Foreign exchange markets have such a large spread and are utilized by a massive number of participants, they supply high liquidity in contrast with various other markets. The Foreign exchange trading market is regularly running, and thanks to modern-day innovation, comes from anywhere. Thus, liquidity describes the fact that any person can get or offer with an easy click of a button.Because of this, there is constantly a possible merchant waiting to purchase or sell making Foreign exchange a fluid market. Price volatility is just one of the most essential aspects that assist choose the next trading step. For short-term Forex investors, rate volatility is crucial, since it depicts the per hour adjustments in an asset's value.

For long-term investors when they trade Foreign exchange, the cost volatility of the market is likewise essential. An additional substantial advantage of Forex is hedging that can be used to your trading account.

7 Simple Techniques For Best Broker For Forex Trading

Depending upon the moment and effort, investors can be split into groups according to their trading style. Some of them are the following: Forex trading can be effectively used in any one of the approaches over. Due to the Foreign exchange market's wonderful quantity and its high liquidity, it's feasible to enter or leave the market any time.

Forex trading is a decentralized innovation that functions with no central administration. A foreign Forex broker must abide with the requirements that are specified by the Foreign exchange regulator.

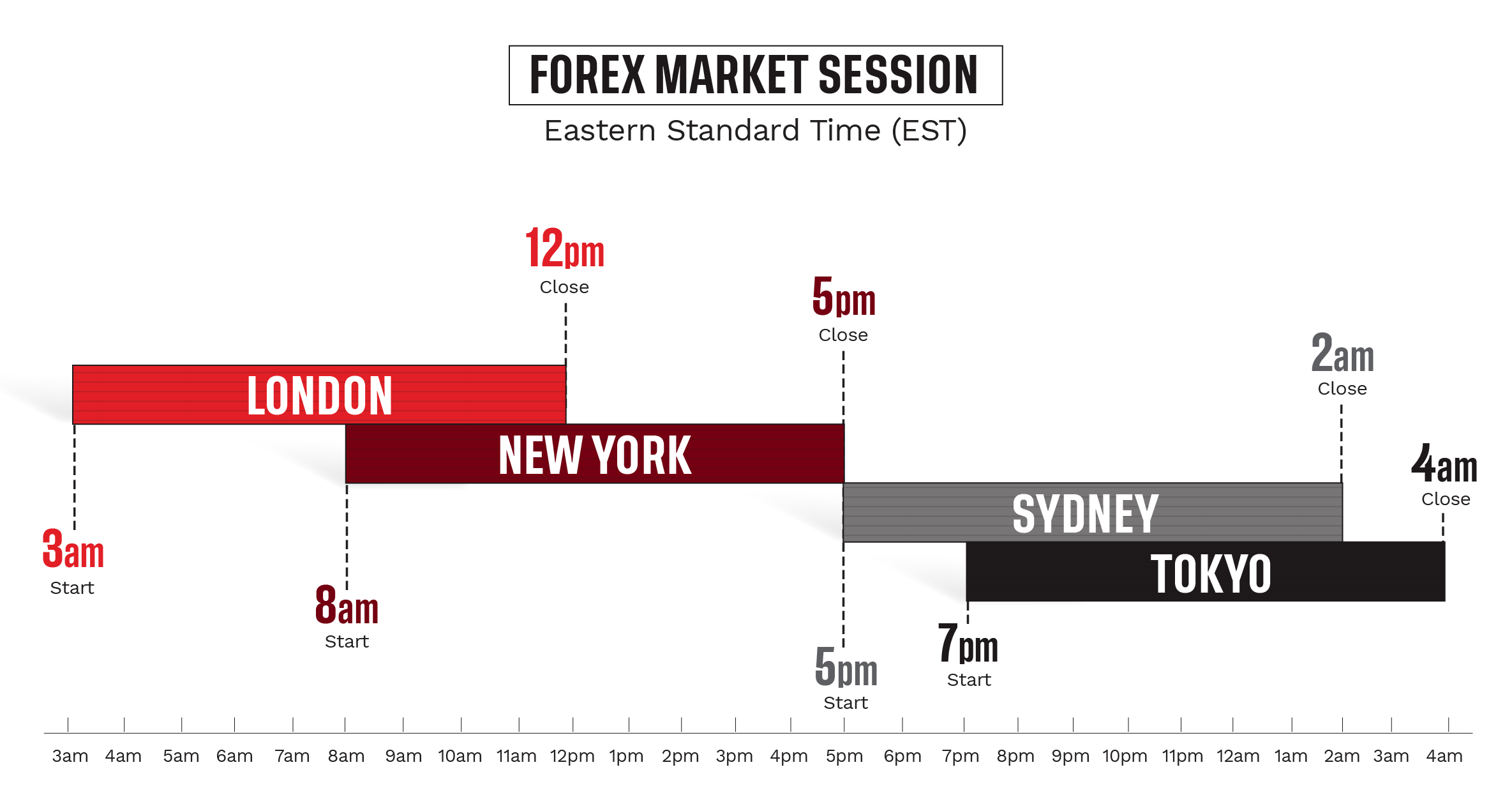

Thus, all the deals can be made from anywhere, and given that it is open 1 day a day, it can also be done any time of the day. If a financier is situated in Europe, he can trade throughout North America hours and keep track of the actions of the one money he is interested in.

Excitement About Best Broker For Forex Trading

In contrast with the stocks, Forex has extremely reduced deal expenses. This is due to the fact that brokers earn their returns via "Things in Portion" (pip). Moreover, the majority of Forex brokers can supply a very low spread and reduce and even get rid of the trader's costs. Investors that select the Foreign exchange market can improve their revenue by avoiding fees from exchanges, deposits, and various other trading activities which have extra retail deal prices in the stock exchange.

It gives the alternative to get in the market with a tiny budget and trade with high-value money. Some traders might not accomplish the needs of high see page leverage at the end of the transaction.

Foreign exchange trading may have trading terms to secure the market participants, yet there is the danger that a person may not value the agreed contract. The Forex market works 24 hr without stopping. Investors can not monitor the changes daily, so they make use of algorithms to secure their passions and their investments. Thus, they need to be constantly educated on just how the innovation works, or else they may face wonderful losses during the evening or on weekends.

When retail traders refer to rate volatility in Foreign exchange, they indicate just how big the growths and drop-offs of a money pair are for a particular period. The larger those ups and downs are, the greater the rate volatility - Best Broker For Forex Trading. Those large adjustments can evoke a feeling of uncertainty, and in some cases traders consider them as an opportunity for high profits.

What Does Best Broker For Forex Trading Do?

Some of the most unpredictable currency sets are considered to be the following: The Forex market offers a great deal of privileges to any Forex investor. Once having actually made a decision to trade on forex, both skilled and newbies need to define their monetary strategy next and get acquainted with the terms.

The content of this write-up shows the author's point of view and does not always show the main placement of LiteFinance broker. The material published on this page is offered educational purposes just and must not be taken into consideration as the provision of investment guidance for the objectives of Directive 2014/65/EU. According to copyright legislation, this write-up is considered intellectual property, which consists of a prohibition on copying and distributing it without authorization.

If your company operates globally, it is essential to recognize how the value of the U.S. dollar, relative to various other money, can substantially impact the rate of goods for U.S. importers and exporters.

The Best Guide To Best Broker For Forex Trading

In the very early 19th century, money exchange was a major component of the procedures of Alex. Brown & Sons, the first investment financial institution in try this out the United States. The Bretton Woods Contract in 1944 needed money to be pegged to the US buck, which remained in turn pegged to the cost of gold.

Report this page